does workers comp deduct taxes

This ensures that you are not taxed on both amounts. This deduction allows your workers compensation benefits to be deducted from your income.

Self Insured Hospital Report Pdf Fpdf Docx Arizona

Yes workers comp payments and benefits that employers pay to their employees are deductible business expenses.

. Spread Payments Throughout Your Policy. Ad No Upfront Workers Comp Insurance Premium Payment. Is workers comp tax deductible.

You should not receive a 1099. Workers Compensation Code 8810. Will I Receive a 1099 or W-2 for Workers Compensation.

But if you receive a lump-sum payout or a settlement from a common law claim. Youll want to make sure to keep track of your premium payments and include them at tax time. IRS Publication 525 pg.

How Does Workers Comp Affect a Tax Return. The IRS does not allow you to deduct workers comp benefits on your tax return. The short answer to this question is no taxes are not normally taken out of workers compensation.

WorkCover should send you a statement of payments like a PAYG summary that you can use. If your total monthly workers compensation benefits or your benefits plus other income are more than the maximum SSI monthly payment amount your SSI application. Discover ADPs Workers Comp Premium Payment Program Pay-By-Pay.

In the eyes of the IRS workers compensation insurance is typically tax-deductible. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

As an employer you are responsible for the total cost of workers compensation insurance and can deduct the premiums you pay from. Skip to content Call us for a. No workers compensation benefits are not taxable at either the federal or the state level theyre generally.

Here we go. This code is the same throughout the United States including the. Just like its good practice to protect your employees and your business with workers compensation.

The quick answer is that generally workers compensation. When a state law allows an employer to opt out of a state workers compensation system state regulations that ensure minimum benefit levels do not apply. Are taxes normally taken out of workers compensation payments.

Your workers compensation benefits will be subtracted from your taxable income. Workers compensation code 8810 refers to administrative and clerical work. Do I have to Pay Taxes on Workers Comp Benefits.

While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC. Report the amount shown in box 14 of your T4 slips on line 10100 of your Income Tax.

Business owners are able to deduct the costs of required.

Workers Compensation Reimbursement For Mileage Rechtman Spevak

What Wages Are Subject To Workers Comp Hourly Inc

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

Is Workers Comp Taxable Workers Comp Taxes

The Complete Guide To Workers Comp Payments Hourly Inc

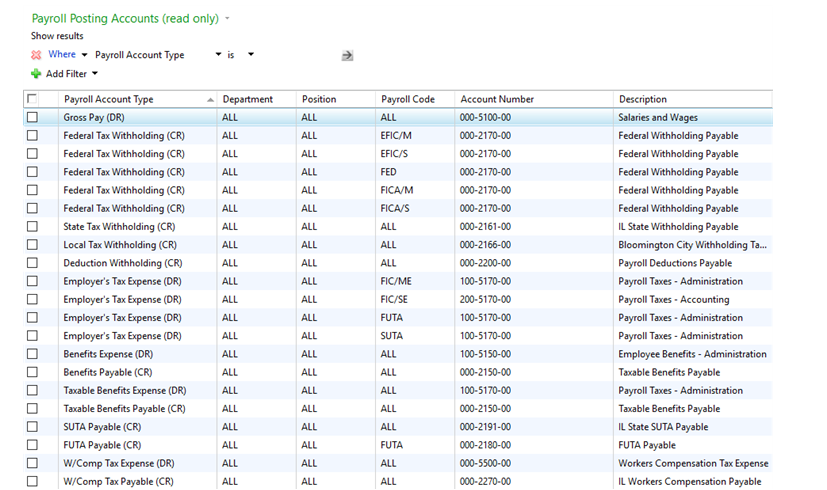

Dynamics Gp U S Payroll Dynamics Gp Microsoft Learn

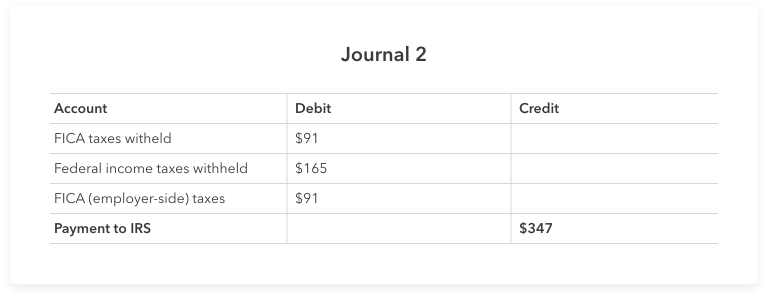

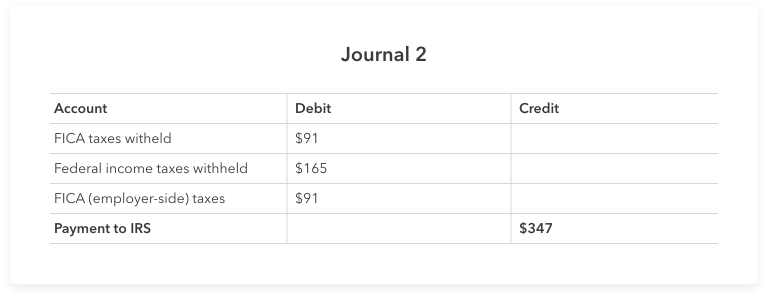

What Is Payroll Accounting A Guide For Small Business Owners Article

Pay As You Go Workers Comp Insurance Adp

19 Self Employment 1099 Tax Deductions Bench Accounting

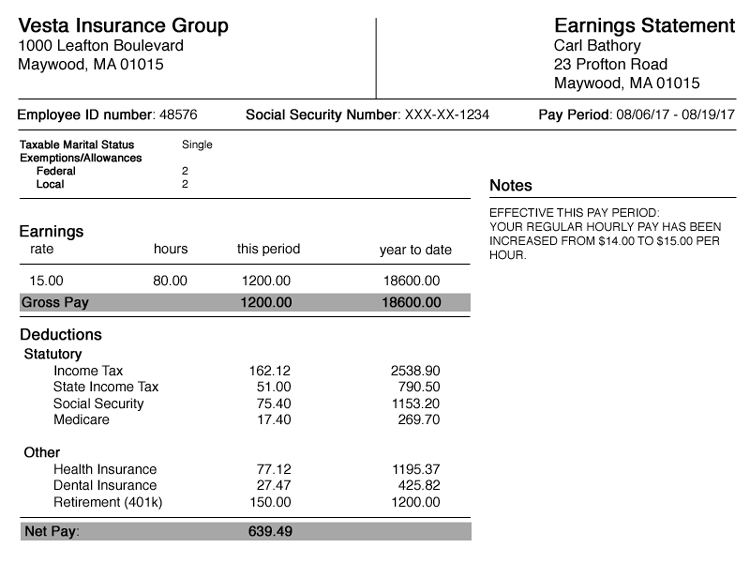

Workplace Basics Understanding Your Pay Benefits And Paycheck

The History Of Workers Compensation Workers Compensation Attorneys

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

Workers Comp Settlement Chart Average Payout Expectations

New Jersey Workers Compensation Insurance For Small Business Insureon

The Ultimate List Of Tax Deductions For Online Sellers In 2020 Gusto

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

What Are Pre Tax And Post Tax Payroll Deductions Hourly Inc

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon