iowa state income tax calculator 2019

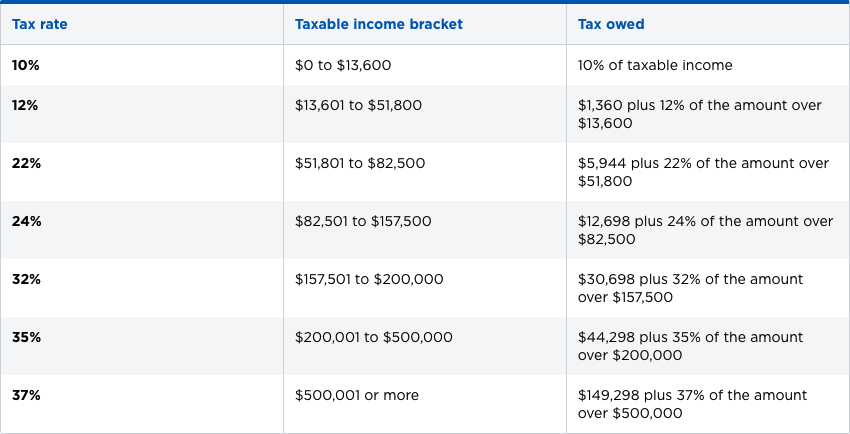

By calculating your estimated tax you can prepare you finances to make sure. The 2019 income tax brackets are as follows.

Iowa Tax Law Makes Some Changes Now But Others Are Far Off And Contingent Center For Agricultural Law And Taxation

Your total tax payments for the year were 0.

. Before the official 2022 Iowa income tax rates are released provisional 2022 tax rates are based on Iowas 2021 income tax brackets. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Your taxes are estimated at 4244.

Your AMT tax is calculated as 26 of AMTI up to 199900 99950 for married couples filing separately plus 28 of all AMTI over 199900 99950 for married couples filing separately. The income tax rate ranges from 033 to 853. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer.

The Iowa State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Iowa State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator. To calculate the Iowa Earned Income Tax Credit multiply your federal EITC by 15 15.

Please use the calculators report to see detailed calculation results in tabular form. The provided information does not constitute financial tax or legal advice. The Iowa Earned Income Tax Credit is a refundable credit.

Your household income location filing status and number of personal exemptions. Nonresidents and Part-Year Residents. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a.

Please make sure. Check the 2019 Iowa state tax rate and the rules to calculate state income tax. New construction employers pay 75.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Your outstanding tax bill is estimated at 4244. 2022 Tax Calculator Estimator - W-4-Pro.

The Iowa Department of Revenue is responsible for publishing the latest Iowa State Tax. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. The calculator is updated for all states for the 2019 tax year.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income Tax Rates and Thresholds in 2022. How to Calculate 2019 Iowa State Income Tax by Using State Income Tax Table. 2020 Iowa State Tax Tables.

2019 Iowa Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Idaho State Tax Quick Facts. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents.

Switch to Iowa hourly calculator. Iowa has a population of over 3 million 2019 and is the leading producer of corn in the world second to China. Contributed amount in 2019.

Appanoose County has an additional 1 local income tax. Enter your annual salary. Iowa tax forms are sourced from the Iowa income tax forms page and are updated on a yearly basis.

Contributed amount in 2019. State Tax Tables for 2019 displayed on this page are provided in. Find your gross income.

After a few seconds you will be provided with a full breakdown of the tax you are paying. 2019 Iowa State Tax Tables. If line 66 is less than line 58 subtract line 66 from line 58 and enter the difference.

As of 2019 Iowas state income taxes range from 033 to 853 depending on income bracket. Fields notated with are required. Details of the personal income tax rates used in the 2022 Iowa State Calculator are published below the calculator this.

Your net income from all sources line 26 is 13500 or less and you are not claimed as a dependent on another persons Iowa return 32000 if you or your spouse is 65 or older on 123119. This credit is available only to taxpayers who qualify for the federal Earned Income Tax Credit EITC. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

To find out if you qualify for federal EITC see the IRS EITC information or call the IRS at 1-800-829-1040. Iowa State Income Tax Forms for Tax Year 2021 Jan. 2017 Iowa State Tax Tables.

You can quickly estimate your Iowa State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Iowa and. If youre a new employer congratulations you pay a flat rate of 1. We strive to make the calculator perfectly accurate.

About Iowa income tax withholding. Find your income exemptions. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year.

The 2022 state personal income tax brackets are updated from the Iowa and Tax Foundation data. Leave it blank if you dont have itemized deduction. Enter those data which can reduce your tax liability.

So exactly how much is Iowa state tax. 2016 Iowa State Tax Tables. IA 1040 - Iowa Individual Income.

Iowa state income tax. This is 849 of your total income of 50000. If the amount you owe line 70 is large you may wish to check the Withholding Calculator to estimate your recommended withholding.

2018 Iowa State Tax Tables. Using our free Iowa tax calculator can make figuring out how much you owe much easier. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

The mission of the Iowa Department of Revenue is to serve Iowans and support state government by collecting all taxes required by law but no more. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Iowa State Income Tax.

54-130a - Iowa Rent Reimbursement Claim. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

The personal exemption was eliminated starting in the 2019 tax year just as they. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Resident of Appanoose countty need to pay 1 local income tax.

Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck calculator. The 2022 rates range from 0 to 75 on the first 34800 in wages paid to each employee in a calendar year. The median household income is 58570 2017.

Adjusted Federal Income Tax. Iowas new online secure portal GovConnectIowa is now available. Your taxes are estimated at 4244 Column Graph.

As an employer in Iowa you have to pay unemployment insurance to the state. In addition to the exemption provisions above if you were a nonresident or part-year resident and had net income. If the AMT tax calculation results in an amount that is greater than your normal income tax you owe the difference as AMT.

Sharing helps to keep the Iowa Salary and Iowa State Tax Calculator free to use. Find your pretax deductions including 401K flexible account contributions. So if you pay 2000 in Iowa state taxes and your school district surtax is.

Llc Tax Calculator Definitive Small Business Tax Estimator

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Delaware Taxes De State Income Tax Calculator Community Tax

Delaware Taxes De State Income Tax Calculator Community Tax

Taxation Of Social Security Benefits Mn House Research

Federal Income Tax Brackets Brilliant Tax

Federal Income Tax Brackets Brilliant Tax

State Corporate Income Tax Rates And Brackets Tax Foundation

Llc Tax Calculator Definitive Small Business Tax Estimator

Irs State Tax Calculator 2005 2022

How The Tcja Tax Law Affects Your Personal Finances

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Hawaii Income Tax Hi State Tax Calculator Community Tax

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)